- Startseite

- auto must haves

- The Self-Directed Solo 401k Auto Enrollment Tax Credit (aka Auto Contribution Arrangement) Continues in Year 2024 - My Solo 401k Financial

The Self-Directed Solo 401k Auto Enrollment Tax Credit (aka Auto Contribution Arrangement) Continues in Year 2024 - My Solo 401k Financial

5 (709) · € 20.00 · Auf Lager

Solo 401k Tax Credit: The Free Self-Directed Solo 401k Government Tax Credit-Eligible Automatic Contribution Arrangement (EACA) Under SECURE ACT (aka Auto Enrollment Tax Credit) - My Solo 401k Financial

2023-24 CTXEBC Benefit Guide (TSHBP) by FBS - Issuu

How to create a Roth 401k for my business - Quora

Can You Have More Than One 401(k)? Yes, Here's How!

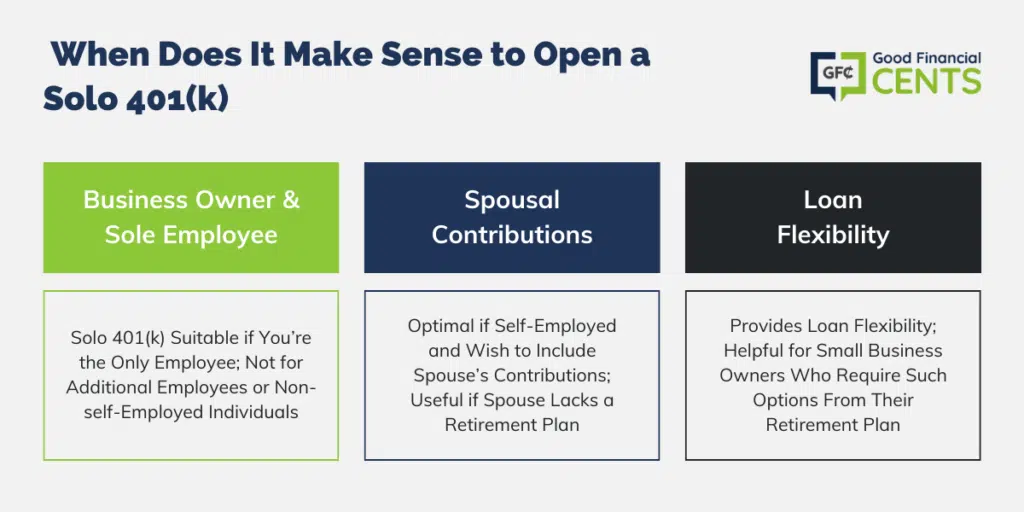

Solo 401(k) Rules and Contribution Limits for 2023

6 Best Solo 401(k) Providers - Student Loan Planner

Solo 401k Contribution Limits for 2022 and 2024

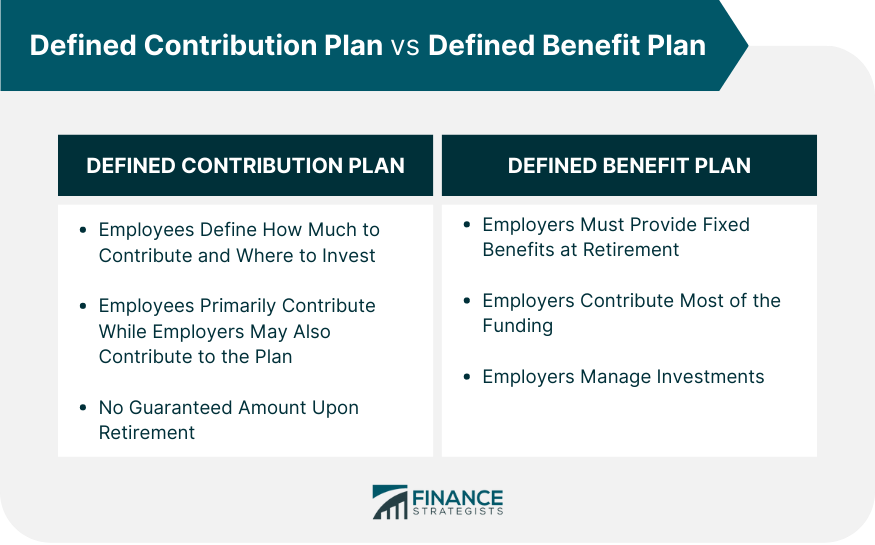

Defined Contribution Plan Meaning, How It Works, Pros & Cons

401(k) and Retirement Planning Services

Mark Nolan on LinkedIn: How do I title Solo 401k accounts for my spouse? - My Solo 401k Financial

MySolo401k.net (@MySolo401k) / X

Compare tax deduction vs tax credit for solo 401k - My Solo 401k Financial

Backdoor Roth IRA 2023: A Step by Step Guide with Vanguard - Physician on FIRE

Pre Tax Income - FasterCapital